Navigating turbulent world of Nasdaq trading can be a challenging feat. For investors seeking to capitalize on potential market corrections, shorting ETFs like PSQ and SQQQ present a compelling opportunity. PSQ, the ProShares UltraPro Short QQQ ETF, offers triple the daily opposite gains of the Nasdaq 100 index, while SQQQ, the SPDR DoubleDown Shorts Nasdaq ETF, provides a more subtle 2x inverse exposure. Understanding the benefits and drawbacks of each ETF is crucial for profitable shorting strategies.

- Magnification can amplify both profits and losses, requiring careful position sizing.

- Short selling is a complex strategy that necessitates a deep knowledge of market dynamics.

- Due diligence is paramount before deploying any shorting strategy.

Top 2x and 3x Leveraged ETFs for 2024: SSO, UPRO, and QQXT - A Comparative Analysis

As investors look for to amplify their returns in the volatile market of 2024, leveraged exchange-traded funds (ETFs) have gained significant attention. Two prominent categories capturing investor interest are 2x and 3x leveraged ETFs, presenting amplified exposure to specific sectors or indices. This article delves into a comparative analysis of three popular leveraged ETFs: SSO (replicating) the S&P 500 index, UPRO (targeting) the Nasdaq 100 index, and QQXT delivering exposure to the technology-heavy NASDAQ 100.

- First| SSO: This ETF seeks to deliver double the daily returns of the S&P 500 index. It is a popular pick for investors seeking access to the broader U.S. equity market but desiring amplified gains.

- Turning our attention to| UPRO: This ETF aims to provide triple the daily returns of the Nasdaq 100 index, making it an attractive option for investors seeking high growth potential in the technology sector.

- Rounding out our analysis| QQXT: This ETF provides double the daily returns of the NASDAQ 100 index. It is a good alternative for investors who want exposure to the tech-heavy index but prefer a slightly more moderate level of leverage.

Comparing these three leveraged ETFs reveals their distinct characteristics and potential risks. Understanding the intricacies of leverage is crucial before allocating capital in these instruments.

Tap into Your Tech Potential with QTEC

Are you a tech entrepreneur looking to skyrocket your growth? Look no further than QTEC, the ultimate platform designed to fuel your success. With our comprehensive suite of services, you can scale your operations, attract top talent, and foster lasting connections.

- Gain access to a global network of mentors

- Utilize state-of-the-art facilities

- Benefit personalized support from industry leaders

QTEC is more than just a community; it's your springboard to explosive growth. Embrace the QTEC movement and elevate your tech company.

Top Short ETFs to Consider in a Bear Market: PSQ vs. QID

Navigating a bear market can be tricky, and many investors consider strategies to offset losses. Short ETFs offer a potential avenue for benefitting from a downturn in the market. Two prominent options are PSQ, which mirrors the inverse performance of the S&P 500, and QID, which offers leveraged exposure to the same index's decline.

Choosing between these two ETFs requires careful consideration of your comfort level with risk. PSQ is a classic short ETF, while QID offers increased potential returns, but also larger risks.

Comprehending the dynamics of both ETFs and their performance in various market conditions is crucial for making an informed decision.

Leveraging the Nasdaq: PSQ vs SQQQ - Choosing Your Weapon

The Nasdaq, a behemoth of innovation and boom, can be a tempting playground for investors. But its volatile nature demands strategy. Enter UltraPro QQQ, and ProShares UltraPro Short QQQ, two leveraged ETFs that offer amplified exposure to the Nasdaq's fortunes. PSQ, a multiplier of 3x, is for those who embrace the positive trajectory of the market. Conversely, SQQQ, with its 3x short leverage, allows you to exploit Nasdaq slumps. Choosing your weapon depends on your appetite read more for risk and views.

- Comprehend the risks associated with leveraged ETFs. They are not suitable for all investors.

- Conduct thorough research before making any investment decisions.

- Spread your portfolio to mitigate risk.

Shorting the Future: A Deep Dive into PSQ and SQQQ

For intrepid investors seeking to exploit market downturns, exchange-traded funds (ETFs) like PSQ and SQQQ offer a unique opportunity. These leveraged instruments provide amplified returns when the S&P 500 index drops. PSQ, designed to track the inverse performance of the Nasdaq 100, multiples losses by three times. In contrast, SQQQ aims to provide a similar leveraged exposure against the S&P 500, with a fourfold magnification of declines.

, Nevertheless these potent tools come with inherent risks. Leveraged ETFs are volatile and can generate substantial losses, particularly in unpredictable market conditions. It's crucial for investors to appreciate the complexities of leverage before implementing these instruments. A thorough understanding of risk management strategies is essential for navigating the complexities of short selling through PSQ and SQQQ.

- Leveraged ETFs offer amplified returns when market prices decline.

- PSQ and SQQQ provide unique opportunities for investors seeking to capitalize on market downturns.

- Understanding the risks associated with leverage is crucial before investing in these instruments.

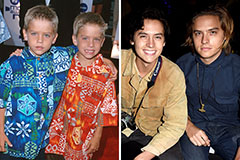

Dylan and Cole Sprouse Then & Now!

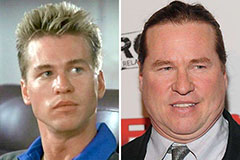

Dylan and Cole Sprouse Then & Now! Val Kilmer Then & Now!

Val Kilmer Then & Now! Marla Sokoloff Then & Now!

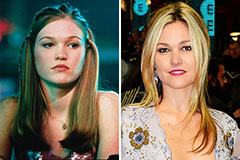

Marla Sokoloff Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now! Sarah Michelle Gellar Then & Now!

Sarah Michelle Gellar Then & Now!